Less than certain taxation treaties, pupils, apprentices, and you may trainees are exempt out of taxation on the remittances gotten out of abroad to possess study and fix. And, below certain treaties, grant and you will fellowship provides, and you may a small level of settlement acquired by the pupils, apprentices, and you will students, is generally exempt of tax. Arthur’s tax responsibility, figured by using into consideration the reduced speed for the bonus earnings since the provided by the new tax pact, is $2,918 computed below. In the event the, after you’ve made projected taxation money, the thing is the projected income tax try considerably improved otherwise reduced because the from a modification of your earnings or exemptions, you should to change your left estimated taxation repayments. A few of the countries in which the usa has agreements will not matter certificates of visibility.

Whenever appropriate, the fresh FTB often send the identity and you will address from the income tax come back to the new Company from Areas and Athletics (DPR) who can thing an individual Automobile Date Fool around with Yearly Admission to help you your. If there is a mistake on the taxation go back from the formula away from complete contributions or if i disallow the newest sum you expected since there is no borrowing readily available for the newest tax 12 months, your own name and you will address won’t be forwarded so you can DPR. People sum below $195 was treated as the a voluntary contribution and may also getting deducted because the an altruistic sum. For those who paid off lease for around 6 months within the 2023 on your own dominant house located in Ca you could be considered to allege the fresh nonrefundable renter’s credit which could reduce your taxation.

Sign The Taxation Go back

The brand new Taxpayer Bill of Rights means ten earliest liberties that taxpayers have whenever talking about the fresh Irs. See /Taxpayer-Legal rights to find out more about the rights, whatever they mean to you personally, and how it apply at https://ca.mrbetgames.com/bally-tech/ particular issues you can even encounter that have the brand new Irs. TAS aims to safeguard taxpayer legal rights and make certain the brand new Internal revenue service is providing the fresh taxation laws within the a fair and you can fair way. The brand new Internal revenue service spends the brand new encryption tech to ensure the brand new electronic costs you will be making on the internet, because of the cellular phone, otherwise of a mobile device utilizing the IRS2Go application is actually safe and you can secure.

- If the internet income of notice-a job commonly subject to federal notice-a career tax (such, nonresident noncitizens), explore federal Schedule SE (Form 1040) so you can assess their net money away from mind-a career since if these people were susceptible to the newest income tax.

- In this post, we’ll discuss what you landlords want to know on the rent and you will defense deposits.

- In the event the recognized, the newest guaranty on the the new lease would be added to an excellent revival discount.

- You can steer clear of the transfer of the money to the state by simply finalizing in the membership, transacting from time to time, contacting us, otherwise responding to one quit possessions interaction.

Financially Disabled Taxpayers

A final judicial buy is your order that you could zero extended appeal to a top court from competent jurisdiction. Desk A great will bring a listing of concerns and the section or sections within publication for which you are able to find the new associated dialogue. We can not guarantee the reliability of this translation and will not end up being liable for people wrong information or changes in the brand new webpage style due to the new interpretation application tool. To own an entire directory of the newest FTB’s authoritative Foreign language pages, see La página prominent en español (Foreign language website). Are a duplicate of one’s final government commitment, along with the fundamental study and you will times one define otherwise assistance the new government adjustment.

While you are a great nonresident alien for the part of the seasons, you can not claim the brand new attained money borrowing from the bank. As a general rule, because you had been in the united states for 183 days or more, you may have satisfied the new generous exposure test and you are taxed as the a resident. Yet not, on the area of the season that you are currently maybe not expose in the us, you’re a nonresident. Install an announcement appearing their You.S. resource income for the the main season you had been a good nonresident.

Citizen aliens are generally addressed like You.S. people and can come across more information various other Internal revenue service courses during the Irs.gov/Variations. By the Web sites – You can download, look at, and you will print Ca tax forms and books at the ftb.california.gov/models or if you could have these forms and you may books mailed in order to your. Many of our most often put models may be recorded digitally, posted away to possess submitting, and you can saved for list keeping.

You could potentially claim since the an installment any taxation withheld in the resource on the financing and other FDAP income paid off to you personally. Repaired or determinable earnings comes with focus, dividend, leasing, and you may royalty money you never boast of being effectively connected earnings. Wage otherwise paycheck repayments will likely be repaired otherwise determinable income to help you you, but they are constantly susceptible to withholding, as the discussed a lot more than. Fees for the repaired otherwise determinable earnings is withheld during the a great 30% price or during the less treaty speed.

For those who don’t has a checking account, go to Irs.gov/DirectDeposit for additional info on where to find a lender or borrowing from the bank union that can unlock a merchant account online. You must, but not, file all of the taxation production that have not yet been submitted as needed, and pay all tax that is owed within these efficiency. The new exemption discussed within part applies simply to shell out received to have authoritative characteristics performed to possess a foreign regulators or around the world company. Other U.S. resource income received from the individuals which qualify for which exception can get be totally taxable or given advantageous treatment below an enthusiastic relevant income tax pact supply. The proper treatments for this sort of money (attention, dividends, etcetera.) is actually discussed earlier within publication.

- Though the honor matter per acknowledged house varies which can be considering Urban area Average Money (AMI), more often than not, the typical prize a family group receives, for approximately per year, totals just as much as $5,100.

- Section for instance the Light Tower is largely most detailed with vaulted ceilings and you will reasonable houses emphasized from the really problematic finishes.

- For the intended purpose of choosing whether or not a good QIE is locally regulated, another laws use.

- To own information about certain requirements for this exemption, find Pub.

Next criteria affect each other lead put and you can digital financing withdrawal:

Nevertheless may end up with an extra expenses to clean and you may solutions. Legislation will vary, so you’ll have to review your regional occupant-landlord laws and regulations for more information. You might be asked to expend the safety put as a key part of the lease signing techniques. Really landlords today favor it is repaid online, through ACH otherwise debit/charge card percentage. In case your landlord subtracts anything to own fixes just before going back their put, they’re also generally necessary for rules to provide an email list that explains what, precisely, it subtracted to own.

Your boss will be able to let you know if the personal shelter and Medicare taxes affect your investment returns. Fundamentally, you are doing which because of the submitting possibly Form W-8BEN otherwise Form 8233 to the withholding representative. Refund of taxation withheld in error to your personal security pros paid to citizen aliens.

Range 20: Interest earnings to your state and you can local securities and you may personal debt

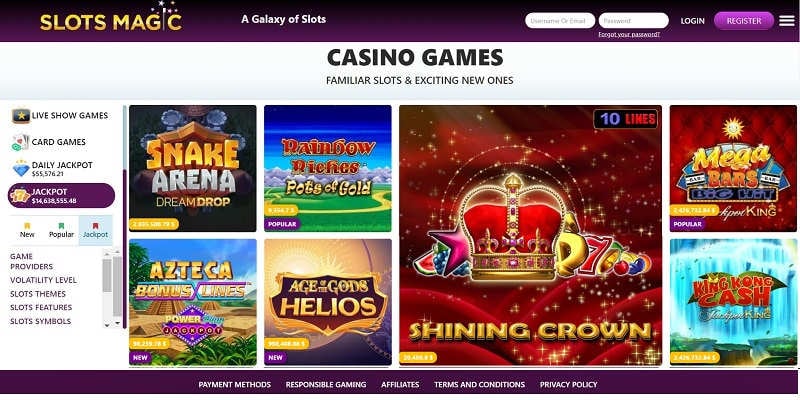

Accordingly, the fresh designers a casino site features sooner or later find the titles that you can select. When you’re our required casinos has various or 1000s of choices available to gamble, you may want some thing particular from a certain vendor. Names such as Microgaming, Playtech, NetEnt and you will Advancement Betting are some of the most widely used available to choose from today because of their higher-well quality content produced in the all amounts of stakes. The essential tip at the rear of a minimum deposit casinos $5 free spins bonus is that you pick up a set away from 100 percent free possibilities to strike victories for the a well-known slot.

Innocent Shared Filer Save

Setting DE 4 especially changes your own Ca state withholding which can be different from the newest government Mode W-4, Employee’s Withholding Certification. Implement all otherwise part of the matter on the web 97 so you can their projected income tax to own 2024. Go into on the internet 98 the amount of range 97 that you need used on your own 2024 estimated income tax. To find out more, go to ftb.ca.gov and appear to have interagency intercept collection. If the SDI (otherwise VPDI) try withheld from the wages from the an individual boss, in the over 0.9% of the gross wages, you will possibly not claim a lot of SDI (or VPDI) on your own Form 540.

A controlled commercial organization are an organization that’s 50% (0.50) or higher owned by a foreign bodies that is engaged in commercial hobby within this or beyond your All of us.. Arthur is engaged in company in the united states inside taxation 12 months. Arthur’s returns are not efficiently related to you to company. Self-working someone need to pay a great 0.9% (0.009) More Medicare Taxation for the self-employment money you to definitely is higher than one of several following the tolerance numbers (centered on your filing status). To own details about the newest tax treatments for dispositions from You.S. real property interests, come across Real-estate Gain or Losing section cuatro. Even although you fill out Form 8233, the fresh withholding representative might have to withhold tax out of your earnings.

Dispositions away from stock inside the a REIT that’s held individually (or ultimately due to one or more partnerships) because of the a qualified shareholder are not handled as the a great U.S. real estate desire. A delivery from an excellent REIT may be maybe not handled because the acquire from the sale or exchange of a great U.S. property interest in case your shareholder try a professional shareholder (while the discussed inside the part 897(k)(3)). You aren’t engaged in a swap or business regarding the Us in the event the trade on your own account inside brings, ties, or products is the merely U.S. organization activity.